Organizational structure

Who we are

The GPW Group includes the leading institutions of the Polish capital and commodity market. It is the biggest exchange in Central and Eastern Europe. The parent entity of the Group is the Warsaw Stock Exchange (“GPW”), which organises tradinhg in financial instruments and pursues a range of educational initiatives to promote economic knowledge of the general public. GPW is the key source of capital for companies and local governments in the region, contributing to dynamic growth of the Polish economy, creation of new jobs, international competitiveness of Polish businesses and the resulting affluence of Poles. Presence on the capital market provides Polish companies with additional benefits including enhanced visibility, credibility, efficiency and transparency in governance.

The TGE Group includes three companies: Towarowa Giełda Energii (TGE), InfoEngine, and Izba Rozliczeniowa Giełd Towarowych (IRGiT). Our companies provide a comprehensive range of services to existing and prospective TGE Members. A member of the GPW Group since February 2012, TGE organises trading on one of the fastest developing capital markets in Europe. The commodity market generates more than 40% of revenue of the GPW Group. This is possible thanks to the broad range of services offered by TGE and its subsidiaries, which operate as a one-stop-shop for existing Members. TGE also operates a Register of Certificates of Origin and a Register of Guarantees of Origin. Through the subsidiary Izba Rozliczeniowa Giełd Towarowych (IRGiT), TGE clears transactions on the TGE commodity market. TGE’s product offer is similar to the product range of the most advanced commodity exchanges in EU Member States. The volume of trading in electricity and gas makes TGE the biggest exchange in the region and a major European market. Considering that TGE products are offered only on the Polish market while many European exchanges come from a few national markets on a shared platform, TGE’s volume of trading confirms its strong position.

Post-trade services for the financial market operated by GPW and BondSpot, including depository, clearing and settlement services, are offered by GPW’s associate, Krajowy Depozyt Papierów Wartościowych S.A. (KDPW S.A.), and its subsidiary KDPW_CCP S.A.

In 2019, the structure of the GPW Group was enlarged by two newly established subsidiaries: GPW Ventures ASI S.A. and GPW Tech S.A. The core business of GPW Ventures ASI S.A. is collecting assets from investors in order to invest them in accordance with a specific investment policy and managing an alternative investment company, while GPW Tech S.A. is dedicated to building, maintaining and commercializing IT solutions supporting the domestic financial and capital market.

GPW Group and associates and joint venture company

Core business of GPW Group companies

| Subsidiary | Business profile |

|---|---|

| BondSpot S.A. | Operates trade in Treasury and non-Treasury debt securities. Treasury BondSpot Poland, operated by BondSpot, is the electronic wholesale market in Treasury securities authorised by the Ministry of Finance and a part of the Treasury Securities Dealers system in Poland |

| Towarowa Giełda Energii S.A. (TGE) | The only licensed commodity exchange in Poland, operates trade in electricity, natural gas, emission allowances, property rights in certificates of origin of electricity, certificates of origin of biogas, energy efficiency certificates; operates the Register of Certificates of Origin of electricity generated from renewable energy sources, high-efficiency cogeneration and agricultural biogas as well as energy efficiency certificates; operates the Register of Guarantees of Origin; operates the Financial Instruments Market |

| Izba Rozliczeniowa Giełd Towarowych S.A. (IRGiT, subsidiary of TGE) | Provides clearing services for all markets operated by TGE. Authorised as a clearing house and settlement institution |

| InfoEngine S.A. (subsidiary of TGE) | Operates an electronic OTC commodity trading platform, provides services to electricity market participants |

| GPW Benchmark S.A. | Licensed administrator of benchmarks on regulated markets (WIG Exchange Index Family, CEEplus) and non-interest-rate benchmarks (TBSP.Index); provides the WIBOR and WIBID Reference Rates – WIBOR is a key benchmark of systemic importance on the Polish money market, used in valuations of most bank loans, derivatives and debt in PLN |

| GPW Ventures ASI S.A. | The core business of the Company is to pool assets of many investors in order to invest such assets in the interest of the investors according to an investment policy, and to manage an alternative investment company |

| GPW TECH S.A. | Develops, maintains and commercialises IT solutions supporting the financial market, in particular the capital market |

The Warsaw Stock Exchange Group was comprised of the parent entity and 7 consolidated subsidiaries as at 31 December 2019. GPW holds a stake in 4 associates.

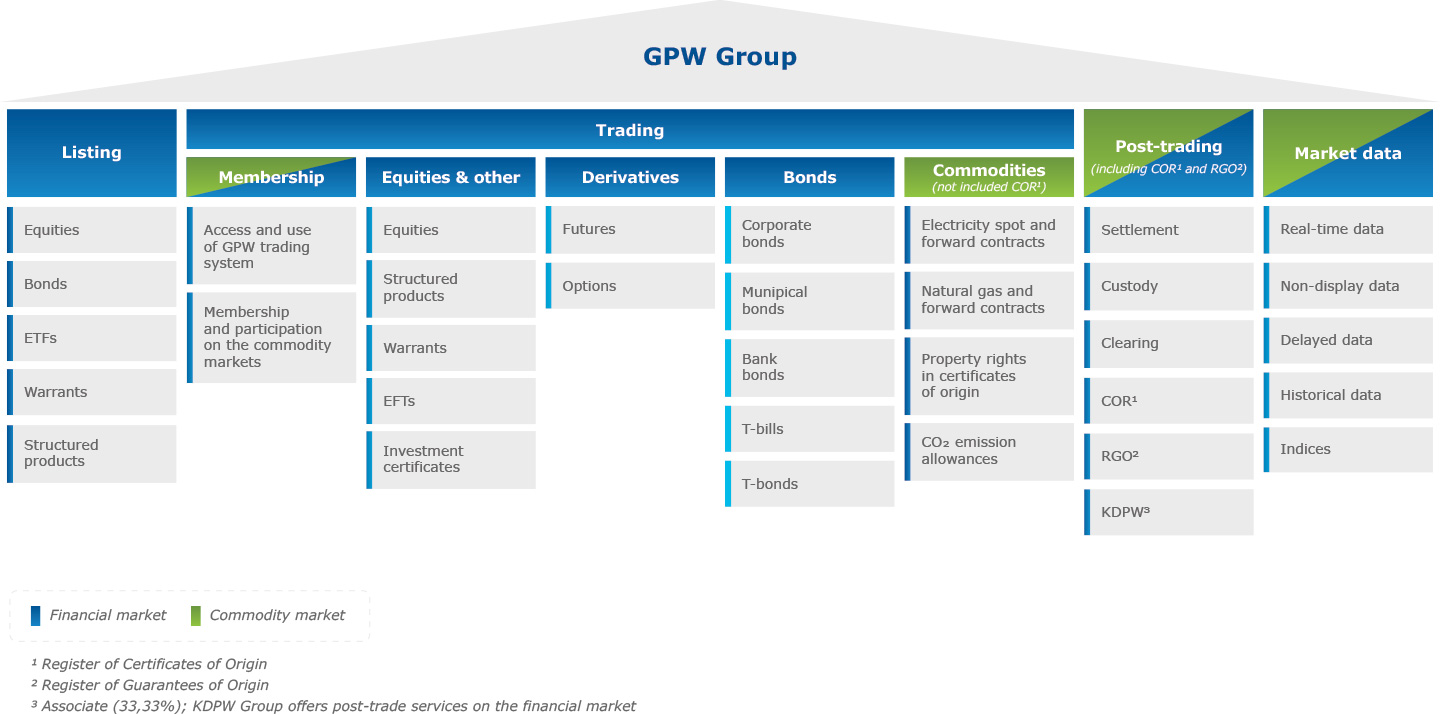

Business lines and product offer of the GPW Group

What makes us different?

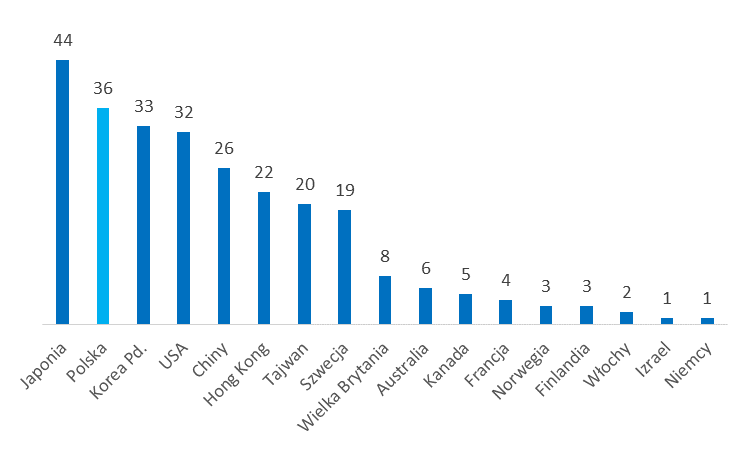

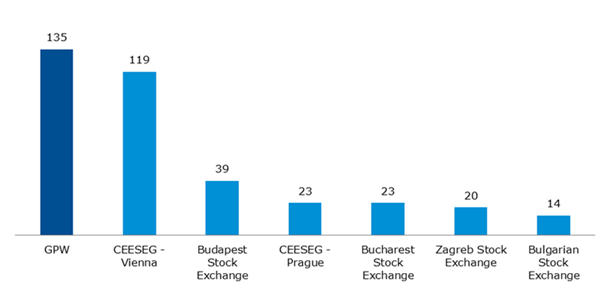

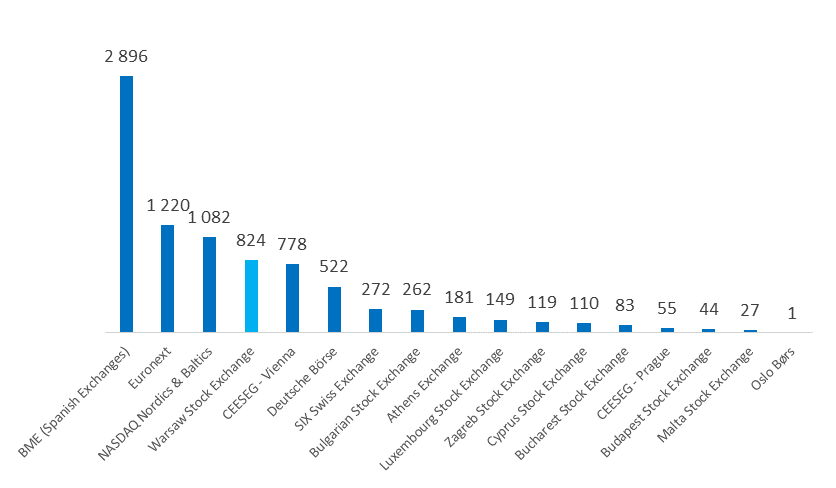

The Warsaw Stock Exchange has the biggest capitalisation of all exchanges in Central and Eastern Europe at EUR 135 billion. It is one of the biggest markets in Europe and lists 824 companies, including 770 domestic companies and 54 foreign companies. The Warsaw Stock Exchange focuses on development and pursues the Strategy #GPW2022 by expanding its product offer and undertaking innovative projects including new technologies. GPW has become an attractive platform for the gaming industry. With 36 gaming companies listed on the GPW markets at the end of 2019, GPW ranked #1 in Europe and #2 globally.

Capitalisation of CEE exchanges (stock markets) at 2019 YE [EUR billion]

Number of domestic and foreign companies listed on European exchanges at 2019 YE

Number of gaming companies listed at 2019 YE