Business Model

The GPW Group includes the leading institutions of the Polish capital and commodity market. It is the biggest exchange in Central and Eastern Europe.

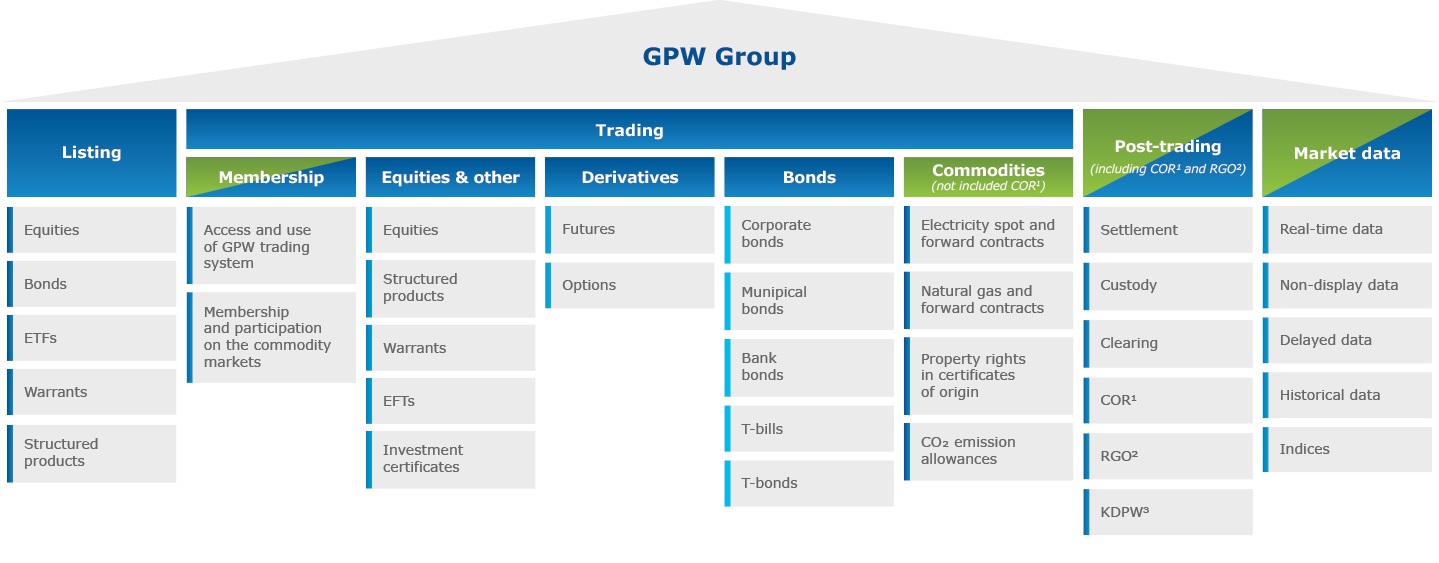

Business Model of GPW Group is focused on services on two important for the polish economy: financial and commodity markets. In both cases, the services offered cover the entire activity chain, from servicing issuers to posttrading services, generating value for listed companies, recipients of information and Exchange Members, and consequently for investors and the entire economy.

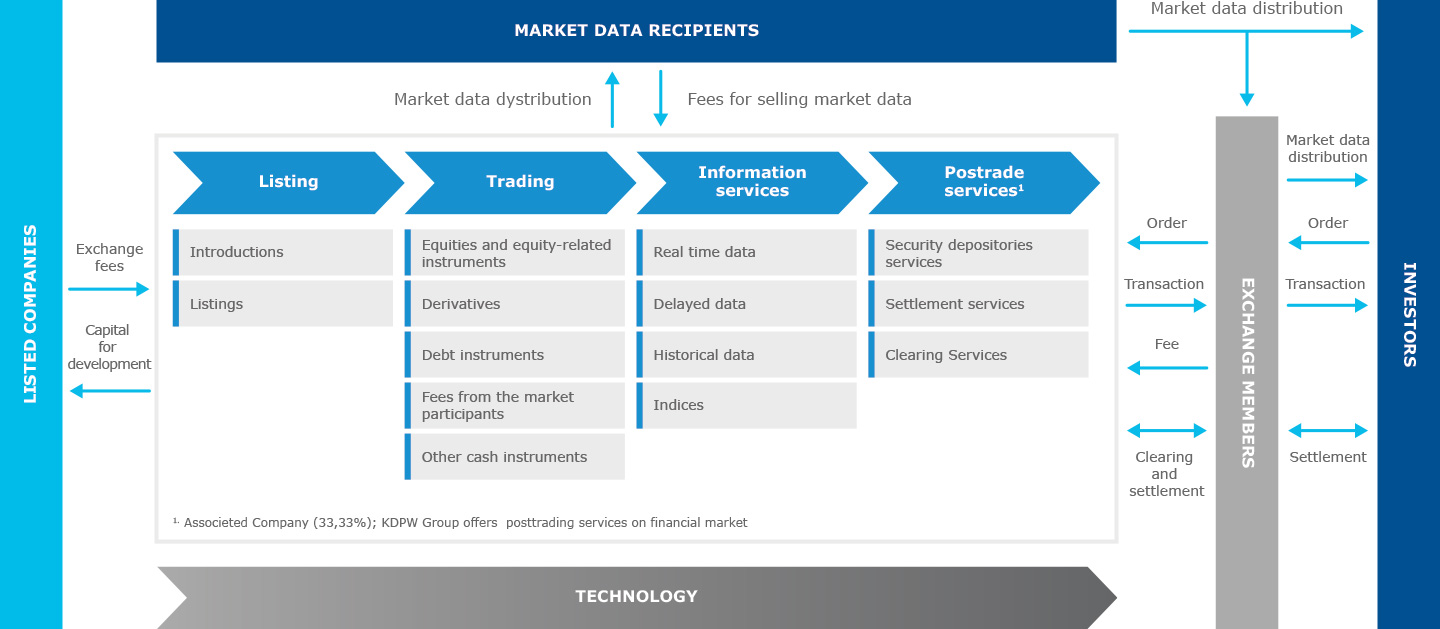

Operations on the financial market

Listing

Listing includes admission and introduction to exchange trading and listing of securities on the markets organised and operated by the GPW Group.

Trading

Trading encompasses trade in financial instruments on the Main Market and on GPW regulated markets NewConnect and Catalyst, and on Treasury BondSpot Poland.

The following instruments are traded on GPW markets: shares and other equity instruments including structured products, warrants, investment certificates and ETF, derivatives namely index futures, single stock futures, currency futures, interest rate futures and options and finally debt instruments: corporate, municipal and mortgage bonds as well as Treasury bills and bonds.

Information services

GPW collects, processes and sells market data from markets operated by the GPW Group.

Post-trade services

Post-trade services for the financial market operated by GPW and BondSpot, including depository, clearing and settlement services, are offered by GPW’s associate, Krajowy Depozyt Papierów Wartościowych S.A. (KDPW), and its subsidiary KDPW_CCP S.A.

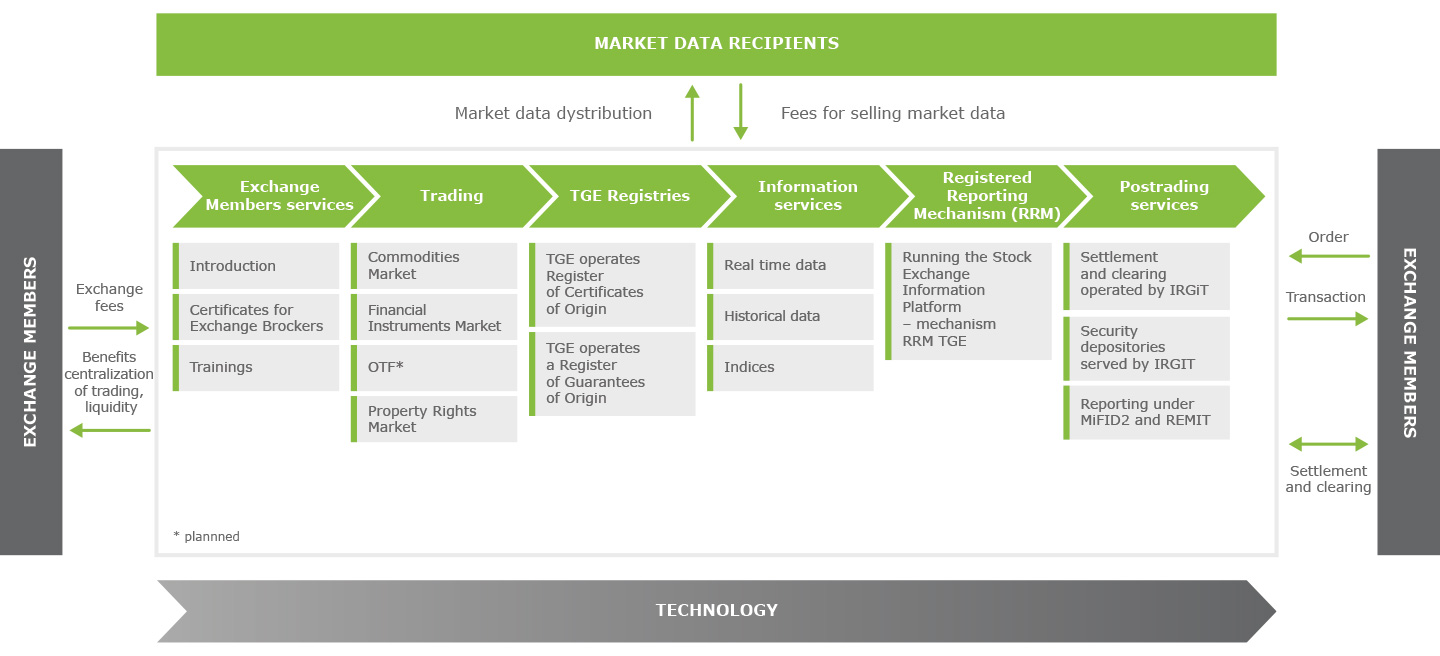

Operations on the commodity market

TGE Members

The service for the members of the TGE Commodity Markets includes the introduction to trading, certification of brokers and training. The parties to transactions concluded on the commodity exchange may be entities that have concluded a membership agreement with the Exchange and have been admitted to operate by the Exchange Management Board.

TGE offers regular training programmes and examinations for Exchange Brokers. Participation in training and passing an examination for Exchange Brokers authorises Exchange Members to trade on TGE.

Trading

Commodity exchange offers trading, among others, in electricity, natural gas, emission allowances, property rights in certificates of origin of electricity, certificates of origin of biogas and energy efficiency certificates and commodity derivatives settled in cash.

Register

The Register of Certificates of Origin is a system of registration of certificates of origin confirming that energy was produced from the renewable energy sources and recording of property rights under such certificates.

TGE operates a Register of Guarantees of Origin and organises trade in guarantees of origin. The Register of Guarantees of Origin launched in September 2014 and registers energy from renewable sources and OTC trade in environmental benefits of its production. Unlike certificates of origin, guarantees do not involve property rights or a support scheme for renewable energy sources: they are issued for information only. There is no obligation to acquire guarantees but they can be used by entities to prove that a certain quantity of consumed energy was generated from renewable sources. TGE offers trade in guarantees of origin of energy since November 2014.

Information services

GPW collects, processes and sells market data from markets operated by the TGE.

Trade reporting - TGE RMM TGE

TGE offers a Registered Reporting Mechanism (RRM) to electricity and gas market participants under the requirements of REMIT and its Implementing Regulations, including reporting of trades on organised trading platforms as of 7 October 2015 and OTC trade reporting as of 7 April 2016.

All information required under REMIT and Regulation 1348/2014 is reported for the electricity market and the gas market.

Post-trade services

The Warsaw Commodity Clearing House (IRGiT), which is a subsidiary of TGE, offers clearing of transactions of TGE members on its markets. IRGiT offers also settlement of transactions and it offers the service of reporting trades on the financial market to a trade repository.

GPW Group business lines

GPW is a renowned institution with strong international recognition. For 28 years, we have helped Polish and European companies to raise capital, provided education, and contributed to economic and social development.